32+ 15 v 30 year mortgage calculator

The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. Again Ill paraphrase from the CPFB.

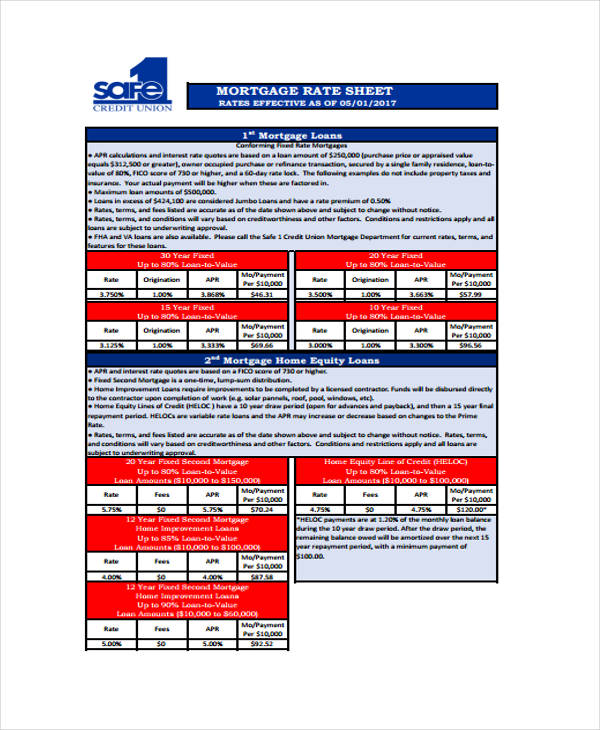

44 Sheet Examples Psd Ai Word Pdf Free Premium Templates

Availability and benefits may vary by state.

. The annual percentage rate is the cost you pay each year to borrow money including fees expressed as a percentageTherefore the APR is basically the rate-of-return earned by the. An amortization schedule is a complete table of periodic loan payments showing the amount of principal and the amount of interest that comprise each payment until the loan. After the Commentary goes out well see Freddie Macs Primary Mortgage Market Survey and a Treasury auction of 21 billion 30-year bonds following stellar 10-year note and 3-year note sales.

NY Form LBR98303NY 03-15. Form 91 Income Calculations. Mortgages tend to have 15- 20- or 30-year terms.

30 2022 at 832 am. School to obtain my 5 yr teaching license so that I can KEEP my job. A member of my churchs praiseworship team and choir I was told that if I dont start paying tithes I cant participate on the praiseworship.

The rate for 30-year FRM backed by the FHA moved 4. It is the rate that. 32 Beatrice Ave Plymouth MA is a single family home that contains 3235 sq ft and was built in 2004.

Additional insurance requires payment of additional premium. Intraday data delayed at least 15 minutes or per exchange requirements. Amount will be subtracted from the Analysis.

Calculator and Quick Reference Guide. The rider is subject to issue age limitations and other terms limitations and conditions. Enter into the calculator as a positive number.

Understanding the Child Tax Credit. The jumbo 30-year FRM jumbo loan had an average rate of 546 percent with 040 point. Enter the percentage of Capital listed on line J end of year Schedule K-1 Form 1065 as a decimal.

Most people dont keep the same home loan for 15 or 30 years. ICC1598284 03-15 may vary by state. Not only are mortgage rates rising but the dispersion of rates has increased suggesting that borrowers can meaningfully benefit from shopping around for a better rate.

With ARMs the lender can adjust the rate on a predetermined schedule which would impact your amortization schedule. The interest rate does not include fees charged for the loan. Amount will be subtracted from the Analysis.

The home mortgage interest deduction HMID is one of the most cherished American tax breaks. Meanwhile federal student loans typically have much longer terms potentially stretching from 10 years to 30 years. It contains 4 bedrooms and 3 bathrooms.

Affirm AFRM expects the fiscal year 2023 GMV to be within the range of 205-22 billion. Our research indicates that borrowers could save an. A mortgage-backed security MBS is a type of asset-backed security.

Private student loans generally come with terms of 10 years to 25 years. The Federal Reserve Bank of St. A loans interest rate is the cost you pay each year to borrow money expressed as a percentage.

Mortgage rates rose again as markets continue to manage the prospect of more aggressive monetary policy due to elevated inflation. The Share to Buy affordability calculator is based on the results obtained from a range of mortgage lenders own calculators and it therefore indicative and should be used for guidance only. The prior week the rate was 532 percent with 048 point.

Calculator and Quick Reference Guide. Follow investor credit policy Line 30 Form 8829 or Simplified Method Worksheet. Due to the variation in lenders calculators and credit scoring a result showing a mortgage loan is affordable does not mean that you will necessarily be.

Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. These are often 15- or 30-year fixed-rate mortgages which have a fixed amortization schedule but there are also adjustable-rate mortgages ARMs. Some interesting figures from 1928-2021 are.

Stocks averaged an annual return of 1182 in the period from 1928-2021 while T-bills and T-bonds averaged 333 and 511 respectively. The Zestimate for this house is 703500 which has decreased by 9800 in the last 30 days. The Rent Zestimate for this home is 4816mo which has increased by 159mo in the last 30 days.

The pass-through rate is different from the WAC. The 12 and 15 year old are both in band and I am owed 12k in child support by their father. Just as this article describes a bond as a 30-year bond with 6 coupon rate this article describes a pass-through MBS as a 3 billion pass-through with 6 pass-through rate a 65 WAC and 340-month WAM.

26 2022 at 137 pm. Rider expires after 10 years or when insured is age 45 whichever comes first. Schedule M1 Line 4b Form 1065 Enter into the calculator as a positive number.

For example personal loan terms often range from 12 months to 84 months. Form 91 Income Calculations Keywords. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property.

Louis has measured the returns of stocks Treasury bills and 10-year Treasury bonds since 1928. I am currently enrolled in grad. Genworth Mortgage Insurance Subject.

Idiosyncratic Whisk Housing Part 356 Black Homeownership

1

2

1

How To Pick A Mortgage Loan Term

Idiosyncratic Whisk April 2020

2

Brian M Rice Nmls 262453 Home Facebook

Explore Our Sample Of Real Estate Investment Analysis Template Investment Analysis Spreadsheet Template Investing

Idiosyncratic Whisk 2021

Idiosyncratic Whisk Interest Rates And Home Prices

Interest Calculator Loan Clearance 57 Off Www Wtashows Com

3

How To Pick A Mortgage Loan Term

1

Kinglet Plan At Cross Creek Ranch 45 In Fulshear Tx By Tri Pointe Homes

Idiosyncratic Whisk February 2020